The renewable natural gas market in Canada

Canada’s Renewable Natural Gas Market Potential

Canada saw its first renewable natural gas (RNG), or biomethane, plant installed in 2003. But recently, Canada’s biogas industry has been a hot topic and an industry-wide discussion.

“When will legislation and country wide incentive programs be finalized?” “What is the quantifiable total demand potential from the Canadian market?”

Today’s Canadian biogas market holds much promise. Experts estimate the country’s RNG demand potential equal to the Californian market, famed with the Low Carbon Fuels Standard (LCFS). With California’s total RNG consumption in 2019 at approximately 140 million DGE, how will Canada stack up? The RNG industry eagerly awaits the finalization of Canada’s Clean Fuels Standard (CFS), an important part of Canada’s climate plan. The goal of the CFS program is to

- Reduce emissions,

- Accelerate the use of clean technologies and fuels, and

- Create good jobs in a diversified economy.

Additionally, the CFS obligates liquid fuel suppliers to reduce the amount of carbon created in the production of their fuels. These regulations will provide an incentive to develop RNG projects that would otherwise struggle to compete in today’s energy markets. Until the new regulations take effect, Canada will continue to rely on a combination of exporting RNG to the U.S. and utility incentive programs.

Biomethane Market Segmentation

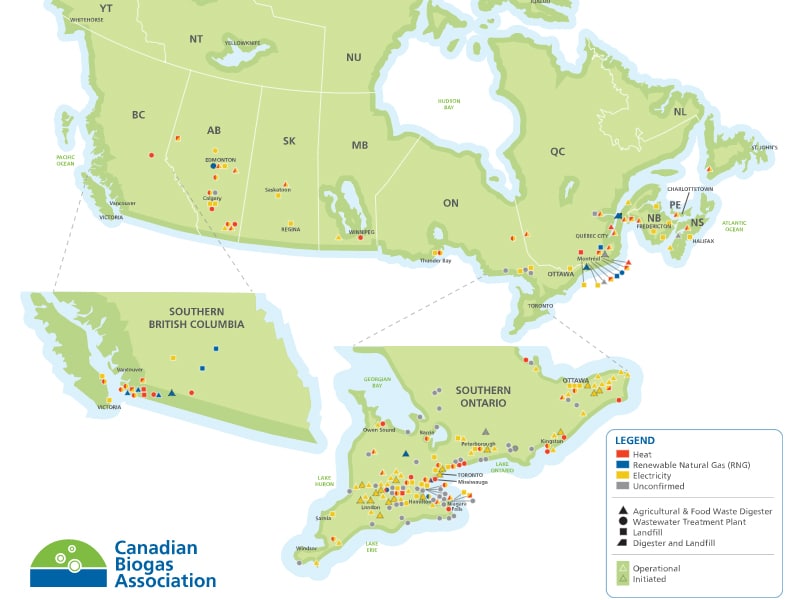

From a biogas feedstock perspective, all kinds of waste are used amongst Canada’s existing 12 operational RNG plants. With more than 100 projects in development and under construction, RNG is manifesting in traditional market segments that DMT thrives in. These markets include landfills, agriculture, food waste, and wastewater.

An Emphasis on Dairy RNG Development

The dairy sector may benefit most of all from the new regulations due to the sheer number of dairy farms in Canada. There are approximately 1,200 dairy farms in British Columbia and Alberta as well as 5,000 farms in the Quebec province.

If Canadian policy mimics the U.S.’ Renewable Fuel Standard (RFS), dairy farms offer low carbon intensity (CI) scores and increased RNG prices. These revenue opportunities create a strong business case and incentivize all projects, small or large in scale.

DMT offers standardized and pre-engineered systems to the dairy industry. This approach offers versatility and wide application to dairy farms regardless of size. After last year’s performance, DMT demonstrates we can reduce lead times significantly because of a standardized model. This allows customers to be online quicker, selling RNG sooner, and generating early revenue.

DMT’s Local Presence and Sourcing in Canada

DMT has been active within the Canadian market for some time. Firstly, our earliest biogas system was installed in 2012 just outside of Toronto. This year, DMT will complete two new RNG systems in British Columbia and Ontario. Both of these systems will produce RNG from dairy manure. As we continue to develop the Canadian RNG market, all projects will be delivered through DMT’s Canadian incorporated enterprise, registered in British Columbia.

Additionally, all DMT projects in Canada will use components from Canadian suppliers. Other technology vendors will import systems from Europe or the U.S., resulting in significant complications such as logistic delays or lack of compliance. DMT chooses to support the local economy instead. The development of DMT’s extensive network of local vendors and partners in the last six years results in efficient project execution for all North American RNG projects.